Search

All-Employee Meeting:

On Wednesday, April 8, 2026, all branches and departments will be closed for an all-employee meeting. As always, online and mobile banking are available any day, any time. Thank you!

Annual Meeting of Members:

Tuesday, April 28, 2026, at 4PM EST, at Workers Credit Union Headquarters, 119 Russell St, Littleton, MA 01460. Click here to view PDF.

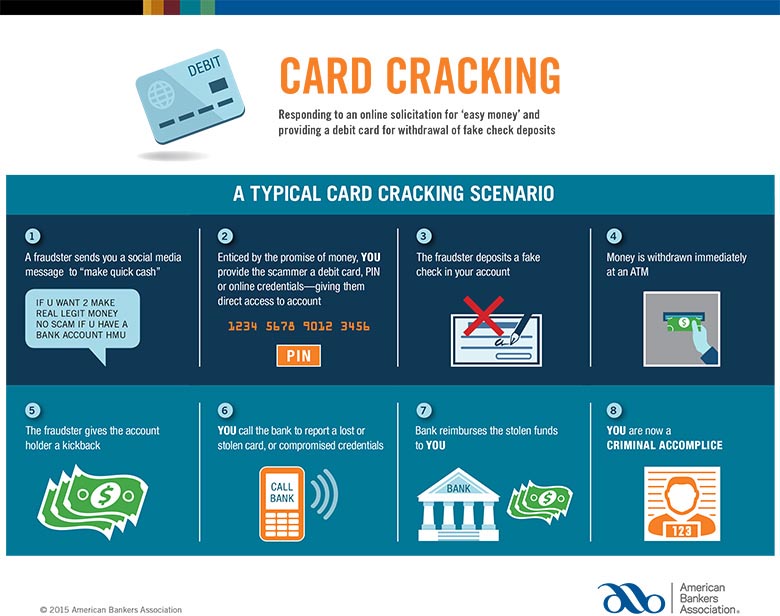

We have all probably seen examples of a card cracking scam without even knowing it. They are everywhere nowadays with people looking for alternative ways to supplement their income in order to keep up with rising costs. Let's review what card cracking is and how we can avoid becoming a victim.

"Card Cracking" is a form of fraud where a person will respond to an online solicitation either through a social media on Facebook, Instagram, Twitter, an email, or even a text message, offering "quick cash" or "easy money" and requires you to provide debit card information for withdrawal of a fake check deposit. Once the fraudster has your account information they will deposit a fake check into the account and withdraw the cash with promise of a kickback to you for your assistance. The fake check deposit will bounce leaving you with a returned item fee and no kickback from the fraudster. Now you must report the card to your financial institution as stolen and be issued a new card. If you file a dispute for stolen funds to be reimbursed, you become an accomplice to the fraud occurring.

Tips to avoid becoming a victim:

The holiday season is one of the busiest times of year and primetime for fraudsters to strike. With just a little awareness and a few smart habits you can outsmart them. We go over common scams to watch out for this year and some tips to stay safe.

Read MoreFraudsters are getting more sophisticated every day and unfortunately, they are targeting people just like you. In this blog we go over the top six of the most common scams affecting credit union members right now and what you can do to avoid them.

Read More